TAXES IN SPAIN. SOCIAL SECURITY FOR SELF EMPLOYEES (AUTONOMOS)

In Spain there are several regimes in order to pay to the Social Security, but there are two main cases: “régimen general” and “autónomos”. The first one is for employees who aren´t shareholders or directors of the company with no

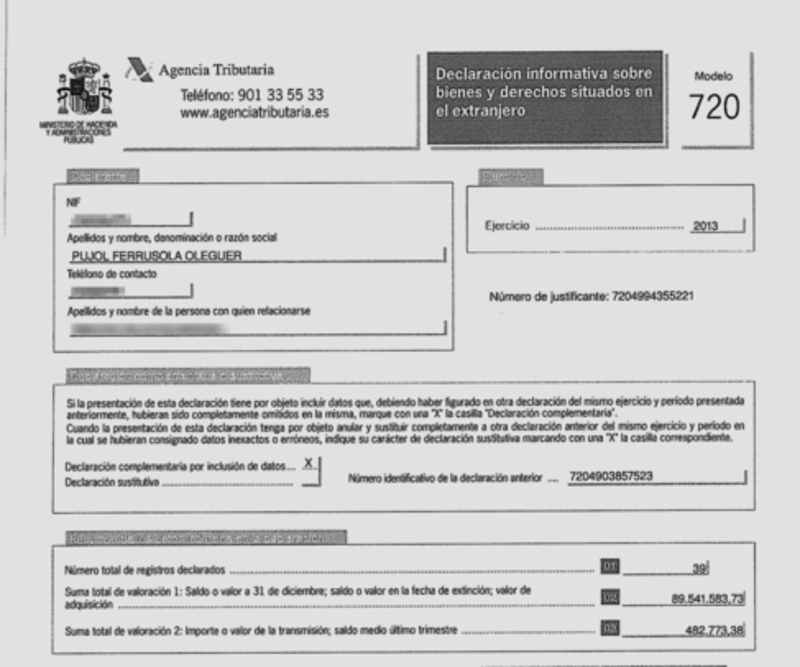

TAXES IN SPAIN. FORM 720 ABOUT ASSETS ABROAD

The form 720 is one of the most important obligations for tax residents in Spain. However it is quite unknown specially for foreigners who are tax residents in Spain for the first time. Maybe this is because most people has

TAXES IN SPAIN FORM 720 IN MARCH

March is the month to submit the form 720 to the Tax office (“Hacienda”). Remember that you have to prepare this important form mainly if you have abroad more than 50.000 euros in any of these three types of assets:

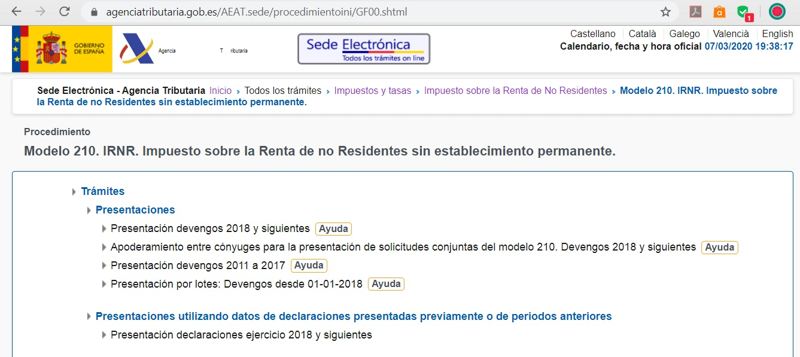

What is Form 210 in Spain?

Form 210 in Spain is the mandatory declaration for taxpayers who are not registered as tax residents in Spain, but who still receive income in Spain. This income can be received through different channels, such as: Leased property Dividends Business

We start the income tax campaign

As of today we officially start the Renta 2021 tax campaign at AGL. Although some of you have already asked us to download tax data in the last few weeks, we are now focusing on the preparation of your tax

Main reasons to have a tax audit of your income tax declaration in spain

When you or your tax advisor prepare your income tax return, there are some mistakes that cause almost automatically a tax audit. Please read the following lines in order to avoid it. 1. Differences between the declarated data and those that

Some tips to prepare your income tax declaration in Spain if you are foreigner

If this is your first time to declare your Income Tax return in Spain, from AGL we explain you some tips to do it: Download and check your fiscal data of the year. You can obtain them at the website

10 tips about Spanish taxes if you are foreigner

The fiscal systems are different in each country. Although Spanish taxes are similar in other countries, there are some points that you should know in order to avoid problems with the Spanish tax office. From AGL we have prepared a

10 key aspects to fill in and submit Form 347

Deadline to submit Form 347 is the last day of February. Are we obligated to submit this declaration? What operations must we include? These days of February our clients ask us about various aspects related to this form, a form

Form 360 – Refund of input VAT in other countries other than one’s own

As internationalization grows, it is increasingly common for professionals or companies to pay VAT in countries other than their own. Form 360 aims to help these professionals or companies to get this input VAT refund. This form, actually, is one of