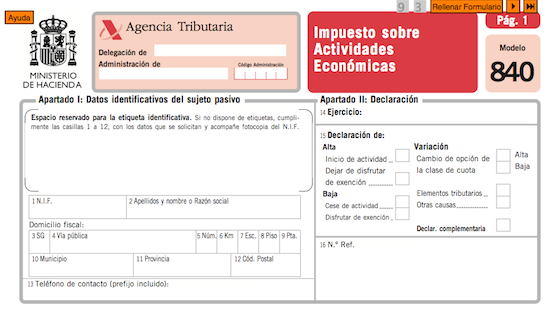

TAXES IN SPAIN. THE IAE (IMPUESTO SOBRE ACTIVIDADES ECONOMICAS)

A company that invoices more than one million euros in a fiscal year has to pay the “Impuesto sobre Actividades Económicas”, IAE. When should a company pay this tax? In case the company invoices more than one million euros. Anyway the companies

TAXES IN SPAIN: THE VAT. A GENERAL VIEW

TAXES IN SPAIN - FINANCIAL ADVISORS IN SPAIN The VAT, “IVA” in Spanish, is the indirect tax with similar structure as in other European countries. These are the main features of this tax (updated 2021). Which are the tax rates? There are three

TAXES IN SPAIN. THE PERSONAL INCOME TAX

The incomes received in Spain by persons are taxed with the Income Tax (“Impuesto sobre la Renta” or “IRPF”). These are some of the main features of this tax in Spain: The incomes are splitted between “renta general” and “renta del

Form 210: for The Sale Of Real-Estate By a Non-Spanish Resident

The sale of real-estate in Spain from Non-Spanish Residents is taxed by the “Non-Resident Income Tax” (IRNR) rate. This requires a series of obligations for both the buyer and seller of the property. The Buyer must submit Form 211 (modelo 211)