Form 210: Non-Spanish Residents Renting Out Property in Spain

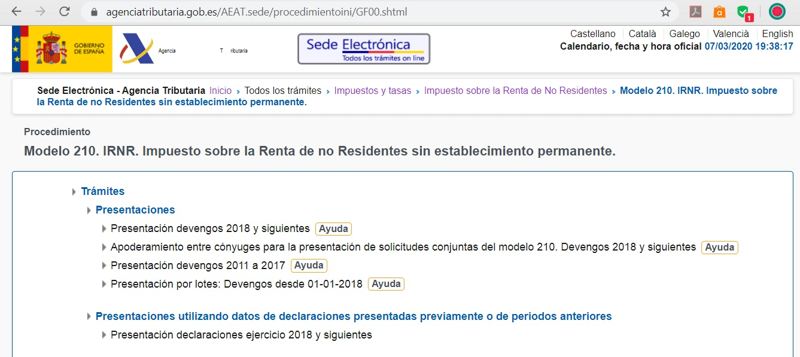

What is Form 210? Form 210 is the compulsory declaration for people who are not registered as tax residents in Spain, but still receive income there. What is the Process for Submitting Form 210 If you are not a permanent Spanish resident living

What is Form 210 in Spain?

Form 210 in Spain is the mandatory declaration for taxpayers who are not registered as tax residents in Spain, but who still receive income in Spain. This income can be received through different channels, such as: Leased property Dividends Business

Form 210: for The Sale Of Real-Estate By a Non-Spanish Resident

The sale of real-estate in Spain from Non-Spanish Residents is taxed by the “Non-Resident Income Tax” (IRNR) rate. This requires a series of obligations for both the buyer and seller of the property. The Buyer must submit Form 211 (modelo 211)