Possible problems with the change of tax residence to Spain

Nowadays, either because of the possibility of teleworking or because of the attractiveness that Spain has for foreigners to come to our country (concentration of companies of some sectors in certain cities, climate, culture, gastronomy, etc.) it is becoming more

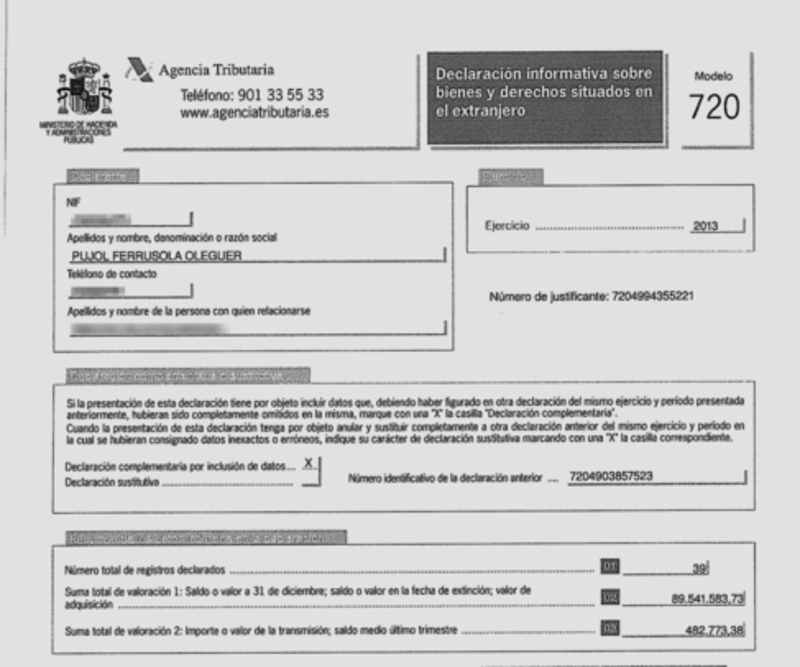

TAXES IN SPAIN. FORM 720 ABOUT ASSETS ABROAD

The form 720 is one of the most important obligations for tax residents in Spain. However it is quite unknown specially for foreigners who are tax residents in Spain for the first time. Maybe this is because most people has

TAXES IN SPAIN FORM 720 IN MARCH

March is the month to submit the form 720 to the Tax office (“Hacienda”). Remember that you have to prepare this important form mainly if you have abroad more than 50.000 euros in any of these three types of assets:

Form 720 of assets abroad. Consequences of the sentence of the European Court In January 202

If you are tax resident in Spain and you have assets abroad you will be interested in this summary of the consequences of a recent sentence, warning of some points of this form that are against EU laws. We explain

Form 360 – Refund of input VAT in other countries other than one’s own

As internationalization grows, it is increasingly common for professionals or companies to pay VAT in countries other than their own. Form 360 aims to help these professionals or companies to get this input VAT refund. This form, actually, is one of

10 key aspects to fill in and submit Form 347

Deadline to submit Form 347 is the last day of February. Are we obligated to submit this declaration? What operations must we include? These days of February our clients ask us about various aspects related to this form, a form

10 tips about Spanish taxes if you are foreigner

The fiscal systems are different in each country. Although Spanish taxes are similar in other countries, there are some points that you should know in order to avoid problems with the Spanish tax office. From AGL we have prepared a

Some tips to prepare your income tax declaration in Spain if you are foreigner

If this is your first time to declare your Income Tax return in Spain, from AGL we explain you some tips to do it: Download and check your fiscal data of the year. You can obtain them at the website

Main reasons to have a tax audit of your income tax declaration in spain

When you or your tax advisor prepare your income tax return, there are some mistakes that cause almost automatically a tax audit. Please read the following lines in order to avoid it. 1. Differences between the declarated data and those that

We start the income tax campaign

As of today we officially start the Renta 2021 tax campaign at AGL. Although some of you have already asked us to download tax data in the last few weeks, we are now focusing on the preparation of your tax