TAXES IN SPAIN. THE VAT. THE SII

The SII (Suministro inmediato de información) The SII (Suministro inmediato de información) is the system of information that the Spanish Tax office has for some companies in relation with the VAT Who has to submit the information to the SII? Big companies, that

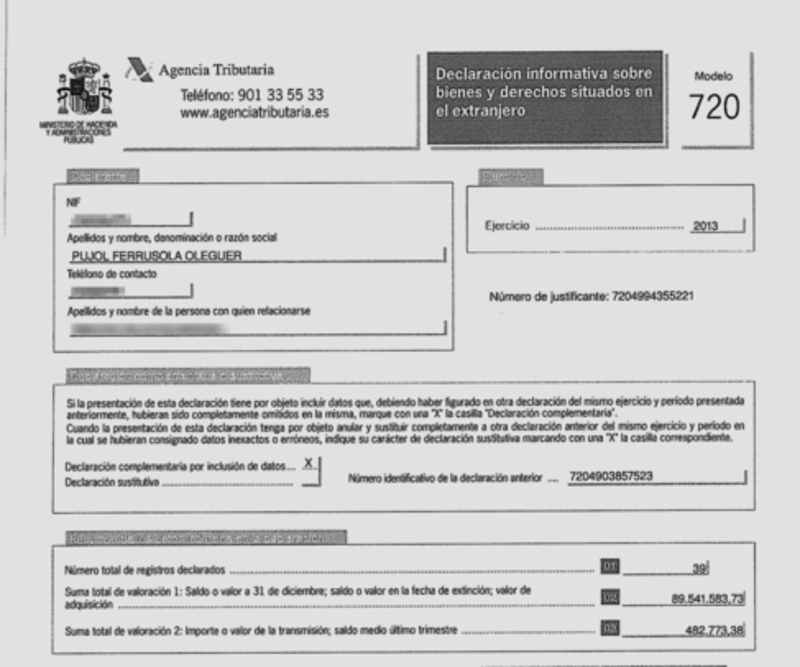

TAXES IN SPAIN. FORM 720 ABOUT ASSETS ABROAD

The form 720 is one of the most important obligations for tax residents in Spain. However it is quite unknown specially for foreigners who are tax residents in Spain for the first time. Maybe this is because most people has

TAXES IN SPAIN. SOCIAL SECURITY FOR SELF EMPLOYEES (AUTONOMOS)

In Spain there are several regimes in order to pay to the Social Security, but there are two main cases: “régimen general” and “autónomos”. The first one is for employees who aren´t shareholders or directors of the company with no

TAXES IN SPAIN: THE VAT. A GENERAL VIEW

TAXES IN SPAIN - FINANCIAL ADVISORS IN SPAIN The VAT, “IVA” in Spanish, is the indirect tax with similar structure as in other European countries. These are the main features of this tax (updated 2021). Which are the tax rates? There are three

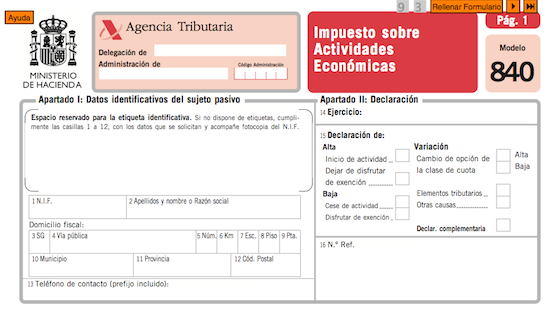

TAXES IN SPAIN. THE IAE (IMPUESTO SOBRE ACTIVIDADES ECONOMICAS)

A company that invoices more than one million euros in a fiscal year has to pay the “Impuesto sobre Actividades Económicas”, IAE. When should a company pay this tax? In case the company invoices more than one million euros. Anyway the companies

TAXES IN SPAIN – HOW TO DECLARE RENTAL INCOMES IN SPAIN AS NON-RESIDENT

In case you have, as a natural person non-resident for taxes in Spain, a real estate in this country and you are obtaining rental incomes you´ll have to declare it in the Income Tax for non residents (“Impuesto sobre la

Some tips to prepare your income tax declaration in Spain if you are foreigner

If this is your first time to declare your Income Tax return in Spain, from AGL we explain you some tips to do it: Download and check your fiscal data of the year. You can obtain them at the website

Main reasons to have a tax audit of your income tax declaration in spain

When you or your tax advisor prepare your income tax return, there are some mistakes that cause almost automatically a tax audit. Please read the following lines in order to avoid it. 1. Differences between the declarated data and those that

We start the income tax campaign

As of today we officially start the Renta 2021 tax campaign at AGL. Although some of you have already asked us to download tax data in the last few weeks, we are now focusing on the preparation of your tax