TAXES IN SPAIN. THE IAE (IMPUESTO SOBRE ACTIVIDADES ECONOMICAS)

A company that invoices more than one million euros in a fiscal year has to pay the “Impuesto sobre Actividades Económicas”, IAE.

When should a company pay this tax?

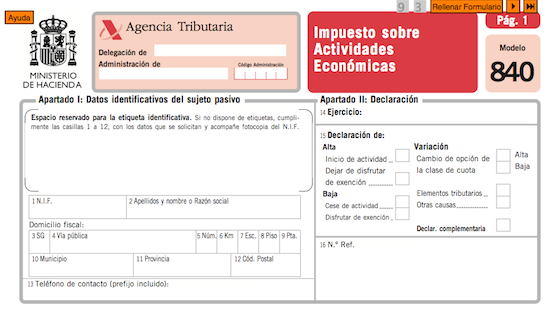

In case the company invoices more than one million euros. Anyway the companies don´t have to pay this tax the first two years of activity and start to pay it two years after the company reach the limit of one million euros. Eg if the company has revenues of 1,1 M. euros in 2020, it will pay IAE in 2022. In December 2021 the company should submit a declaration to the tax authorities informing about its revenues over one million euros and other data as the area of the premises and the activity.

In case of a group of companies, which is the turnover to calculate to reach the limit of one million euros?

In these cases, the Tax office has considered that the turnover is the global revenue of the group, but just in case the companies have to be audited compulsorily. Otherwise it is just the individual revenue.

How much has to pay the company yearly?

The amount depends on several points:

- The activity of the company and, in some cases like industrial activities, the fiscal power, in Kw.

- The area of the premises used by the company.

- Some coefficients in relation with where the premises are located (street, town, etc.)

- The turnover of the company, although this amount has a little importance in the calculation of the tax.

The amount to pay yearly can go from a little cost (200-500 €) to a high amount in case of premises with large areas and a high number of kw as fiscal power.

Take into account that the amount to pay is composed by two parts:

- One according to the activity, that can be a fixed amount eg shops, professional activities, etc. or variable in case of industrial activities (calculated according the fiscal power in kw)

- The second part, calculated based on the surface of the premises.

Which tax administration is the responsible of this tax?

The IAE is a local tax, but the procedure of submitting the declarations, payments, etc. can be done by the local authorities (“ayuntamiento”) or other entities as the “Diputación Provincial” or the (Central) Tax Office, so in every case must be checked.

If you need more information about this tax you can contact us at jose@asesoriagarcialopez.es

Should I pay this tax as a natural person?

No, this tax is only for companies, not for natural persons (freelancers / autónomos)

- In case you issue invoices to clients with VAT number in another EU country, that could be without Spanish VAT due of VAT location rules.

- In case you receive invoice from other EU countries, in order to avoid receiving VAT of these countries. If you haven´t got the Spanish VAT number you can receive these invoices with a VAT of another country that is not directly deductible in Spain. Instead of it, you should use the reverse-charge mechanism, without cost for you in VAT in most of the cases, received the invoice without VAT.

How can I register at the ROI?

You can register submitting the form 036 (“declaración censal”) to the Spanish Tax office (“Agencia Tributaria”). For the companies it is compulsory to do it through the website www.agenciatributaria.es, with digital certificate. For “autónomos” it is also better to do it this way, although you can do it in paper and register it in one of the offices of the Agencia Tributaria.

How long does it take to get it?

If it is a company with several years of activity IN Spain or a Spaniard or a foreign person living in Spain for years, usually the register is quite immediate. However in some cases of foreigners or new companies, specially if there are foreign shareholders or directors of the company, the Tax office can start an audit to check the activity of the autónomo or the company, to verify that the address of the activity and that there is a real activity (employees, premises) and that it is not an “empty-box”. Eg companies with address in a business center or without employees could have problems to get the ROI.

Will I have another Tax Identification Number after being included in the ROI?

Yes, you will have the VAT number for the EU, that will be the same Tax Identification Number in Spain, the NIF, but with ES before the NIF.

How can I check it a VAT number is registered in the ROI?

Through this website VIES – Trámites – Sede Electrónica – Agencia Tributaria you should be able to check it.

If you have any questions about the Spanish ROI you can contact us at jose@asesoriagarcialopez.es