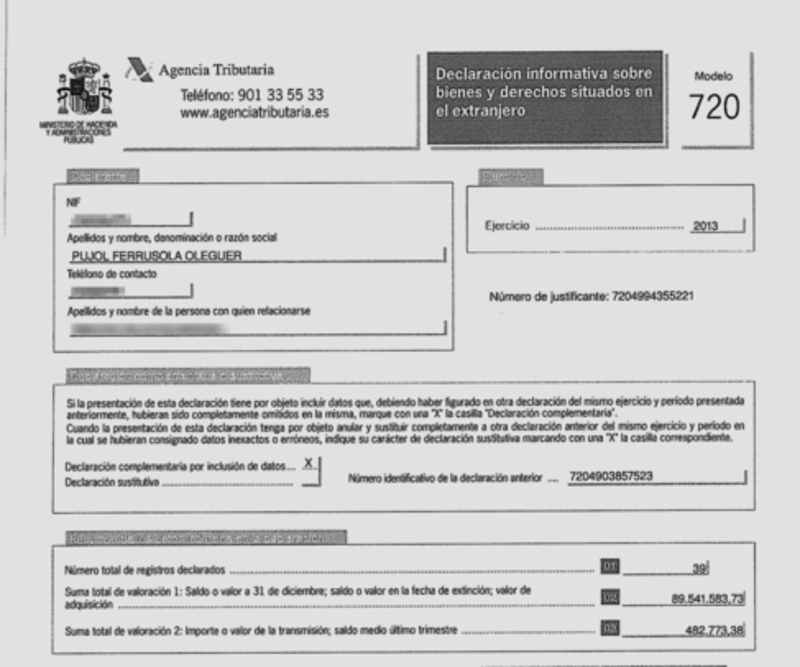

TAXES IN SPAIN. FORM 720 ABOUT ASSETS ABROAD

The form 720 is one of the most important obligations for tax residents in Spain. However it is quite unknown specially for foreigners who are tax residents in Spain for the first time. Maybe this is because most people has no obligation to submit it to the Spanish Tax office. But you have to check if you have to prepare it as not doing when you are obliged to it can have important and unwanted consequences.

Who has to submit the form 720?

Tax residents in Spain who at the end of the fiscal year have more than 50.000 euros in any of these three kinds of assets:

- Bank accounts

- Investment funds, shares and similar financial products

- Real properties: houses, lands, offices, industrial premises, etc.

The amount of 50.000 can be in any of these three types of assets. Eg if you have bank accounts with 10.000 euros and investment funds with 45.000 euros, you have no obligation to prepare the form 720.

But if eg you have a joint account with your couple with 80.000 euros (40.000 each), then you have to submit the declaration.

What can happen if I do not prepare this declaration?

There are extremely high penalties for not submitting on time these declarations. We strongly advice to prepare them on time and correctly as there are also high penalties if there are incorrect data in the declaration. We advice to prepare it with a tax advisor with experience in this type of declaration.

When I should prepare it?

For 2020, the term to submit this declaration ends in March 2021. However, as you have to inform about some data that sometimes are not easy to find (cost of acquisition of real properties, date of opening of bank accounts, full details of bank accounts, etc.) you should prepare this information well in advance.

If you have any questions you can contact us in order to prepare a quote of our fees.

- Big companies, that have invoiced more than six millions euros in the previous year, as they have to prepared monthly tax declarations, not only for VAT but also for withholding taxes, etc.

- Companies included in REDEME, a special regime for those companies that want to prepare monthly their declarations in order to claim the VAT balances in their favour at the end of every month instead of at the end of the year. In this way the companies can receive these amounts faster (usually in two or three months after the declarations). Otherwise they would receive the VAT return in May / June of the next year, as the tax refund could be only requested in January, when preparing forth quarter declaration.

Although it is not usual some companies can submit their registers with the SII voluntarily.

What does the SII consist of?

It is the information to submit to the tax office through the Tax office website with the main datas of the incoming and issued invoices. This information has to be sent in the period of four days since the invoice has been issued or four days since the invoice has been received in case of incoming invoices.